With the advancement of technology, there are many apps available to help us in our daily activities. #WeUnderstand that managing finances can be tricky. In today’s era, sometimes it’s hard to resist the urge to buy something we want.

Life in big cities often pressures us to buy things just to maintain a certain image, even when those items aren’t truly valuable. To minimise this tendency, many of us try to keep financial records to monitor our cash flow. However, if done carelessly, these notes may end up being ineffective.

See also how to send money from Indonesia to some countries in Southeast Asia

Send Money from Indonesia to Singapura

Send Money from Indonesia to Malaysia

Send Money from Indonesia to Thailand

Send Money from Indonesia to Japan

Send Money from Indonesia to China

So, what should we do to avoid being overly consumptive when managing money? The answer lies in the list of finance apps below that you can download to your smartphone to help you manage your finances better. Scroll down to see more!

1. Mint

One of the most popular finance apps is Mint. Mint is well-known among millennials because it offers all-in-one financial services. Just imagine—within Mint, you can manage bank accounts, investment portfolios, monthly bills, credit loans, and checking accounts. On top of that, you can record monthly expenses so your cash flow stays under control.

2. UangKu

This app is perfect for those who are new to financial management apps. Not only is UangKu easy to use, but it also offers suggestions on daily spending limits. This way, you can manage your money more purposefully.

3. Level Money

For iOS users, this is a must-try. Level Money helps you monitor your finances—whether from bank accounts or credit cards—so your spending stays in check and you avoid overspending. Another plus? Level Money ensures your financial data remains secure.

4. Money Lover

Another great option for iOS users is Money Lover. With this app, you don’t need to manually record every expense—such as food, transport, holidays, and more. The app takes care of it for you automatically. Sounds fun, right?

5. Wallet

Last but not least is Wallet. This app links to your bank account and automatically records your transactions and balances. One major advantage of Wallet is that it supports multiple currencies, making it versatile for international users.

So, do these 5 apps help you better manage your monthly finances? Hopefully, they can guide you toward a more structured financial life—and maybe even help you allocate your money for something more productive! If you still feel unsure about the best way to manage your monthly budget, check out our complete list of helpful money tips here.

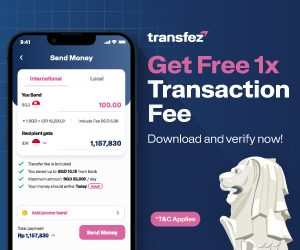

These five apps are proven to be excellent for managing finances. But did you know there’s one more app—developed locally—that helps you send money from Indonesia to abroad easily, safely, and at super affordable rates, helping you reduce monthly expenses? That app is Transfez!

With Transfez, you can send money from Indonesia to 70+ countries across 5 continents, with transfer fees starting from just IDR 45,000. Officially licensed by Bank Indonesia as a Fund Transfer Operator, Transfez guarantees that your transfers are secure and delivered on time.

Have any questions about how to use the app? The Transfez customer support team is always ready to help, and you can easily contact them directly within the app.