In the era of rapidly advancing technology, the terms fintech and digital bank often come up in conversations about finance. Many people assume the two are the same because they are both technology-based and facilitate online transactions.

However, there are some fintech and digital bank differences that you need to understand. Here’s a breakdown.

Read also: Best Apps to Manage Your Finances

Understanding Fintech and Digital Banks

Fintech (financial technology) refers to companies or platforms that use technology to provide financial services more quickly, easily, and efficiently. Fintech typically focuses on specific solutions, such as online loans (peer-to-peer lending), digital payments, or investments. Popular fintech examples in Indonesia include GoPay, OVO, and loan platforms like Kredit Pintar.

On the other hand, a Digital Bank is a general bank that provides banking services through digital platforms, such as mobile apps or websites, with little to no physical branch presence. Digital banks are still legal entities under Indonesian law (Bank BHI) regulated by OJK, just like conventional banks. Examples of digital banks in Indonesia include Jenius (BTPN), Digibank (DBS), and TMRW (UOB).

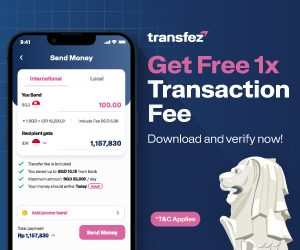

Transfez, Easy Way to Send Money to 70+ Countries Worldwide

Main Differences Between Fintech and Digital Banks

Apart from the definitions, the main differences between fintech and digital banks are explained in detail based on key aspects:

- Legal Status and Regulation

Fintech is not a bank, but rather a financial technology company regulated by OJK Regulation No. 10/POJK.05/2022 on Technology-Based Peer-to-Peer Lending Services. Fintech must be registered with OJK and have a minimum capital of IDR 25 billion when established. However, many illegal fintech platforms operate without proper authorization, so it’s important to check the legal status on the official OJK website.

On the other hand, digital banks are general banks regulated by OJK Regulation No. 12/POJK.03/2021 on Commercial Banks. They must meet strict requirements as Bank BHI, including operational permits from OJK and compliance with banking regulations. Digital banks are also required to ensure customer data security to prevent cyber threats like doxing.

- Services Offered

Fintech usually focuses on specific services. For example, P2P lending fintech platforms like Akulaku offer quick loans with an online application process that takes minutes. Payment fintech services like ShopeePay make e-commerce transactions easier. However, fintech platforms cannot raise funds from the public in the form of savings or deposits like banks.

Digital banks offer a complete range of banking services, from account opening, savings, deposits, credit, to investment products. For example, Jenius allows users to open an account without visiting the bank, manage finances via an app, and even apply for a credit card. Digital banks also provide integrated mobile banking features connected to other banking services.

- Speed and Ease of Access

Fintech is known for its fast processes and more relaxed requirements compared to banks. For example, for a loan on a fintech platform, you only need to upload your ID card and a few documents, and the funds can be disbursed within 24 hours. However, this is often offset by higher interest rates.

Digital banks also offer convenience, but their processes are slightly more stringent due to banking regulations. For example, opening an account at a digital bank usually requires a video call verification to confirm identity. Nevertheless, digital banks like TMRW offer an experience almost as fast as fintech for daily transactions.

- Security and Consumer Protection

Security is one of the advantages of digital banks. Because they are regulated as general banks, digital banks must implement high security standards, including data encryption and protection against information leaks. If a violation occurs, OJK can impose strict sanctions.

Fintech, although regulated by OJK, often faces security challenges. Many illegal fintech platforms abuse customer data or charge exorbitant interest rates. Therefore, it is crucial to only use fintech platforms registered with OJK. In 2025, OJK reported a 20% reduction in illegal fintech cases thanks to stricter supervision.

- Service Fees

Fintech generally offers lower service fees compared to conventional banks. For example, transfers between accounts on fintech platforms like Dana are often free or incur a small fee. However, for loans, fintech interest rates can reach up to 0.8% per day, depending on the platform’s policies.

Digital banks are also competitive in terms of fees. Many digital banks offer free inter-bank transfers or low administrative fees to attract customers. For example, Digibank does not charge a monthly administration fee for certain accounts, making it appealing to younger generations.

- Adoption of Cutting-Edge Technology

Both fintech and digital banks leverage advanced technologies such as blockchain and artificial intelligence (AI). However, fintech tends to adopt new technologies more quickly due to its focus on specific innovations. For example, some Islamic fintech platforms like ALAMI use blockchain for transaction transparency.

Digital banks are also beginning to adopt blockchain, as seen with Bank Mandiri and PermataBank for trade finance transactions. According to 2024 research, the adoption of blockchain in Indonesian digital banks has increased transaction efficiency by up to 30%.

Read also: What is a Bank Branch Code and Where to Find It?

Which One is Right for You?

Choosing between fintech and digital banks depends on your needs. If you need a quick loan with a simple process, fintech might be a good option, but make sure the platform is legal. If you want complete banking services with guaranteed security, digital banks are the best choice.

Here’s a quick guide:

- Choose fintech for: Quick loans, digital payments, or small-scale investments.

- Choose digital banks for: Savings, deposits, credit cards, or daily transactions with high security.

Safe Transaction Tips

For those who frequently use fintech or digital banking services, it’s important to follow these safety tips to avoid fraud:

- Always check the platform’s legality before using it.

- Ensure the platform is protected by strong encryption.

- Do not share sensitive information, like passwords, with anyone.

- Regularly update the app and your password for additional security.

Download the Transfez App

The Transfez app helps you transfer money abroad quickly, affordably, and efficiently. Transfez Business also supports international transactions for your business. Whether sending money to family for studies, work, or travel abroad, Transfez has you covered. Available on Android and iOS. Download now!