In the digital era, banking is no longer synonymous with long queues at branch offices. Now, best digital banks have become the primary choice, especially for millennials and Gen Z who seek convenience, speed, and flexibility in managing their finances.

According to data from Bank Indonesia (BI) as of March 2025, digital banking transactions have grown by 36.1% year-on-year. These transactions could even reach Rp34.5 billion, with the majority of users being young generations. Ipsos Indonesia’s research also shows that 73% of Gen Z and millennials actively use digital banks for their daily needs.

So, which digital bank is most suitable for the lifestyle of young people? Here are 7 of the best digital banks in Indonesia that are favorites among millennials and Gen Z in 2025.

Read also: Remittances Boost Indonesia’s Economy, Transfez Plays a Part Too

1. SeaBank: Top Choice with E-Commerce Integration

SeaBank ranks first as the most well-known digital bank, especially among Gen Z, with a 57% market share according to a 2024 Populix survey. Affiliated with Shopee, SeaBank offers seamless online transaction convenience. Users can enjoy 100 free transfers between banks and e-wallet top-ups per month with no minimum balance or monthly admin fees.

Other notable features include savings interest rates of up to 3.5% per year, ideal for young people who want to start saving without hassle. SeaBank also supports QRIS payments, used by 71% of digital bank users for everyday transactions. Its integration with e-commerce makes it perfect for Gen Z who loves shopping online.

The SeaBank app has a simple and intuitive interface, plus attractive promotions like cashback on Shopee. Perfect for those who want savings and online shopping in one place!

2. Bank Jago: Flexibility with Pocket Features

Bank Jago ranks second with a 36% market share according to Populix. Its flagship feature, the Pocket, allows users to organize their finances for various goals, such as vacation funds or monthly shopping, all in one app. With a deposit interest rate of up to 7% per year, it appeals to millennials looking for light investments.

Bank Jago is also integrated with the GoTo ecosystem, such as GoPay and Tokopedia, making transfers and payments easier. While there has been an admin fee since July 2024 for certain minimum balances, the bank still offers 25 free transfers between banks and 5 free cash withdrawals per month.

The Pocket feature and integration with GoPay make financial management more organized and practical, especially for Gen Z who values flexibility.

Transfez, The Easiest Way to Send Money to 70+ Countries

3. Blu by BCA Digital: Reliability with a BCA Touch

Blu by BCA, a subsidiary of BCA, ranks third with a 25% market share. This app offers 20 savings accounts in 1 account through the BluSaving feature, perfect for young people who want to separate funds for different needs. Savings interest rates of up to 4.25% per year and penalty-free deposits are other advantages.

Blu also offers BluGether, a feature for joint saving up to 25 people, ideal for Gen Z who enjoys splitting bills when hanging out. With no monthly admin fees and free transfers to other banks (under certain conditions), it’s budget-friendly.

BCA’s ecosystem support ensures security and reliability, while features like BluRewards offer attractive cashback for everyday transactions.

4. Jenius: The Pioneer of Digital Banking That Remains Relevant

Jenius from BTPN is the pioneer of digital banking since 2016 and still remains a favorite, ranked 75th in the Global Top 100 Digital Bank Ranking 2022. Features like Flexi Saver and Dream Saver enable flexible savings with interest rates of up to 5% per year, ideal for emergency funds or vacation targets.

Jenius also offers a contactless Visa debit card for international transactions and promotions like cashback on M-TIX or online motorcycle taxis. Even though there’s an admin fee since 2021, features like Split Bill and automatic rounding for savings still attract millennials.

The user-friendly interface and detailed budgeting features make Jenius perfect for young people who want to manage their finances in a modern way.

Read also: Transactions with Transfez Are Safe and Fraud-Free

5. TMRW by UOB: Saving is Fun Like Playing a Game

TMRW, a subsidiary of UOB Indonesia, targets millennials and Gen Z with a unique concept: saving like playing a game in the City of TMRW. The more you save, the more your virtual city grows! With savings interest rates of up to 4.5% per year and connections with e-commerce like Shopee and Tokopedia, TMRW offers additional value.

The TIA Chatbot provides 24/7 customer service, while promotions like Fun Treat Wednesday and 0% installment plans attract Gen Z who love to shop.

The gamification approach and e-commerce promotions make TMRW a fun choice for young people who want to save in a playful way.

6. Digibank by DBS: All-in-One for Investment and Transactions

Digibank by DBS offers a comprehensive solution from savings to investments. The Spending Tracker feature helps Gen Z track spending, while investments and foreign exchange transactions can be done directly in the app. Savings interest rates of up to 3.5% per year and a virtual card for online shopping add to its appeal.

A 24/7 chatbot service ensures assistance at any time, perfect for young people who need instant solutions. Digibank is ideal for millennials who want to combine savings, investments, and international transactions in one practical platform.

7. Bank Neo Commerce: Promotions and High Interest Rates

Bank Neo Commerce (BNC) offers a 100% digital banking experience with savings interest rates of up to 4.25% per year and competitive Neo WOW deposits. The Neo Journal feature helps track transactions, while promotions like cashback and discount coupons attract Gen Z.

BNC is also free from admin fees and bank transfers (under certain conditions), making it an economical choice for young people. The combination of high interest rates and abundant promotions makes BNC a great choice for Gen Z who wants maximum savings benefits.

According to research by Lokadata.id in 2024, 73% of Gen Z and millennials choose digital banks for ease of access (29%) and integration with e-commerce or digital wallets (24%). Features like automatic savings, spending analysis, and free admin fees are also attractive. With QRIS transaction growth of 170.1% YoY as of January 2025, digital banks are becoming more relevant for the cashless lifestyle of young people.

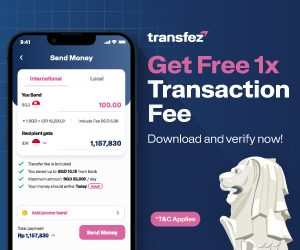

Want to know how to send money abroad easily and cheaply? Use Transfez!

Transfez accounts can be created for free and facilitate international money transfers with lower, transparent, safe, and fast fees to bank accounts abroad.

Simple steps to send money via Transfez:

1. Register an account in the Transfez app,

2. Select the amount to be sent,

3. Verify your identity,

4. Enter recipient information,

5. Make the payment,

6. The money transfer is complete.

Learn more about how to send money abroad with Transfez here, and you may also be interested in trying Transfez’s exchange rate calculator or viewing the destination country list to see how much the recipient will receive when using Transfez.

Download the Transfez App

The Transfez app can help you send money abroad faster, more affordably, and efficiently. Jack Finance can also assist your business in making international transactions. For those wanting to send money to relatives abroad for studies, work, or travel, Transfez is ready to assist. The app is available on Android and iOS. Download now!

Digital banks like SeaBank, Bank Jago, Blu by BCA, Jenius, TMRW, Digibank, and Bank Neo Commerce offer innovation and convenience for managing financial needs, while also supporting the cashless lifestyle of millennials and Gen Z. Each has its own unique features, so choose which suits your lifestyle and financial goals.