The fintech industry in Indonesia continues to grow rapidly. This growth is driven by the adoption of digital technology, a tech-savvy population, and the need for inclusive financial services.

In 2025, several fintech companies in Indonesia stand out for their innovations in providing practical, secure, and affordable financial solutions. Let’s explore 10 of the most innovative fintech companies in Indonesia this year, based on their innovation, impact, funding, and unique offerings. Here’s the list!

Also read: Remittance Boosts Indonesia’s Economy: Sending Money Abroad Made Easier

1. Xendit: Digital Payment Infrastructure

Xendit is a pioneer in providing digital payment infrastructure supporting businesses from small to large scale. Established in 2015, Xendit has become a unicorn with a valuation of over US$1 billion. In 2022, they reported an increase in annual transactions from 65 million to 200 million, with total payment value reaching US$15 billion. Xendit’s innovation lies in simplifying cross-platform payment processes, including QRIS and bank transfers, which greatly benefit MSMEs. They also continue to expand services such as expense management solutions for businesses.

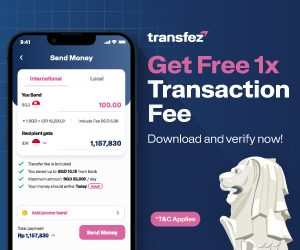

Transfez, Easy Money Transfers to 70+ Countries Worldwide

2. Akulaku: Integrated Digital Finance Solution

Akulaku offers a digital financial platform covering banking, financing, investment, and insurance. Operating in Indonesia, the Philippines, and Malaysia, Akulaku had 26 million users and a valuation of US$2 billion by 2022. That year, they recorded 122% revenue growth and a gross merchandise volume (GMV) of US$5.8 billion. Akulaku’s innovation lies in providing financing services for underserved populations, such as credit card-free installments for online shopping, which is highly relevant in the Indonesian market.

3. DANA: Multifunctional Digital Wallet

DANA is a digital wallet that allows users to make payments, transfer money, pay bills, and shop online easily. In 2022, DANA reported double the total payment volume compared to the previous year. With a valuation of US$1.13 billion, DANA keeps innovating by integrating QRIS payment technology and forming strategic partnerships with platforms like Lazada. DANA’s strengths are its user-friendly interface and high transaction security, making it a favorite among Gen Z and millennials.

4. Ajaib: Investments for Millennials

Ajaib is a wealth management platform targeting millennial investors with services for stock, ETF, and mutual fund purchases. With US$153 million in funding by 2022, Ajaib reached a US$1 billion valuation, making it a fintech unicorn. Its innovation lies in simplified financial education and an intuitive app that allows beginners to start investing with small capital. Ajaib also leverages robo-advisory technology to offer personalized investment recommendations.

5. GoPay: Digital Payments from GoTo

GoPay, part of the GoTo ecosystem, is one of the largest digital wallets in Indonesia. In 2017, GoPay accounted for 30% of total electronic money transactions in Indonesia. Its innovations include integration with Gojek services like transport, food delivery, and offline payments via QRIS. They also offer payment solutions for MSMEs, accelerating financial inclusion in smaller cities. GoPay keeps advancing with features like AI-based payments for faster user experiences.

6. Investree: P2P Lending for MSMEs

Investree is a P2P lending platform connecting borrowers, especially MSMEs, with investors. They focus on affordable and accessible financing. Investree has helped thousands of MSMEs obtain working capital through innovative technology-based credit scoring. In 2020, Investree was listed among the fastest-growing fintech companies in Asia Pacific by IDC. Their strengths are transparency and an easy loan process that supports local economic growth.

7. Hijra Bank: Digital Sharia Fintech

Hijra Bank (formerly ALAMI) is a sharia digital bank offering transfers, daily transactions, and financial management based on Islamic principles. They use innovative technology to provide real-time reports and easy financial control. Hijra Bank stands out for its focus on financial inclusion within Muslim communities—a large market in Indonesia. With a transparent sharia approach, they attract users looking for halal financial solutions.

Read More Transfez Articles on Finance

Best Apps to Manage Your Finances

Currency Ranking from Highest to Lowest

How to Pay Zakat Fitrah Abroad

5 Best Digital Bank Stocks with High Growth Potential in 2025

8. Komunal: Digitizing Rural Banks

Komunal is a fintech company focusing on the digitalization of People’s Credit Banks (BPR) in Indonesia. They work with over 15% of BPRs to offer services like digital savings and loans. Komunal’s innovation lies in reaching remote areas underserved by major banks. With a user-friendly platform, Komunal helps BPRs compete in the digital era and accelerate financial inclusion.

9. Stockbit: E-Trading for the Young Generation

Stockbit is an e-trading platform offering stock trading and robo-advisory services via the Bibit app. They gained attention from millennials and Gen Z during the pandemic with an easy-to-use interface and engaging investment education. Stockbit has received significant funding and continues to innovate with AI-based market analysis. They also promote financial literacy through an active online investor community.

Check the list of countries where you can send money via Transfez here!

10. Fuse: Innovation in Insurtech

Fuse is a leader in the insurtech sector, providing a platform for insurance agents and microinsurance products for e-commerce. They focus on both offline and online insurance education to broaden product distribution. Fuse has expanded the insurance value chain with technologies like digital underwriting. Their innovation is helping increase insurance penetration in Indonesia, which remains low compared to other ASEAN countries.

Want to know how to send money abroad easily and affordably? Use Transfez!

Transfez accounts can be created for free and facilitate international money transfers at lower, transparent, secure, and fast fees to bank accounts abroad.

Steps to send money with Transfez are simple:

1. Register an account on the Transfez app,

2. Enter the amount to send,

3. Verify your identity,

4. Enter the recipient’s information,

5. Make the payment,

6. The money transfer is complete.

Learn more about how to send money abroad with Transfez here. You might also want to try Transfez’s exchange rate calculator or check the list of destination countries to see how much the recipient will receive when using Transfez.

Download the Transfez App

The Transfez app helps you transfer money abroad faster, cheaper, and more efficiently. Jack Finance also helps businesses with international transactions. Whether you’re sending money to family members studying, working, or traveling overseas, Transfez is ready to help. The app is available on Android and iOS. Download now!

These 10 fintech companies in Indonesia have proven to be pioneers of innovation in 2025. From digital payments to investments and insurance, they offer solutions that not only make life easier but also promote financial inclusion. If you’re interested in trying their services, be sure to choose a platform that fits your needs and always pay attention to transaction security.