Nowadays, face-to-face interactions are limited, especially when it comes to payments. As we know, the pandemic has changed many aspects of our daily lives, including how we make transactions. That’s why adapting to new ways, like using a credit card, has become essential.

Especially when you travel abroad, using a credit card as a valid payment method is one of the most convenient and secure options.

How to Use a Credit Card While Abroad

But how exactly do you use your credit card overseas? Here are several important tips to help you.

1. Choose the Right Card Issuer

Every bank offers its own credit card services, each with different advantages and disadvantages. Make sure to select the card that best fits your needs.

2. Check Your Credit Limit

Credit cards make spending easy, but don’t forget to monitor your limit and be mindful of your upcoming monthly bills. Avoid exceeding your limit to prevent unnecessary fees.

3. Save Your Credit Card Call Center Number

In case of issues, keep your card issuer’s official call center number handy. It’s the fastest way to get help and avoid major risks.

4. Understand the Transaction Fees

Each credit card comes with different transaction fees, especially for foreign purchases. Check the fee structure before you travel to avoid hidden surprises and ensure transparency.

5. Keep Your PIN and Card Info Confidential

This is crucial. Never share your card information or PIN with anyone. Also, consider updating your password regularly to prevent fraud or scams, which have become more common.

6. Carry Backup Cash and a Secondary Card

Even though credit cards are accepted almost everywhere, it’s still wise to carry some cash and an ATM card in case of unexpected situations while abroad.

7. Pay Attention to Exchange Rates

Be sure to monitor the exchange rates. A miscalculation could lead to insufficient funds while overseas. Track the rates and plan your spending accordingly.

8. Be Aware of Admin Fees

On top of exchange rates, keep an eye on administrative fees charged per transaction. Knowing this in advance will help you manage your travel budget better.

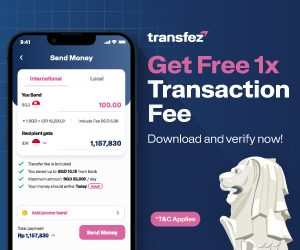

See Video on How to Easily Send Money Abroad with Transfez

By following these 8 tips, you’ll enjoy a safer and smoother credit card experience while traveling. But if you’re staying abroad for an extended period or want to avoid high fees, Transfez is a reliable alternative to send money directly to a local bank account.

Not only is it affordable, but Transfez also offers fast and easy transfers, including real-time transactions to several countries. Still unsure about using Transfez?

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Jack Finance can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.

Try it out now, use the referral code “FREETRY” for your first free transaction! Download the app today on the App Store (iOS) or the Play Store (Android).